Introduction

Fraud detection and investigation presents one of the most popular use cases for graph databases, especially in the financial services industry. But for those not employed directly by a bank or insurance firm, it can be hard to study or experiment with realistic data. If it’s not obvious, a lack of publicly available datasets is a real problem for academics looking to develop machine learning or heuristic approaches to fraud detection.

Lopez-Rojas, Elmire, and Axelsson1 published PaySim, an approach using an agent-based model and some anonymized, aggregate transactional data from a real mobile money network operator to create synthetic financial data sets academics and hackers can use for exploring ways to detect fraudulent behavior.

Check out their initial dataset posted to kaggle: https://www.kaggle.com/ntnu-testimon/paysim1

![Figure 1: “…fingerprints of [PaySim] transactions over time” by Arjun Joshua](/img/kaggle-arjunjoshua-paysim-fingerprints.png)

Figure 1: “…fingerprints of [PaySim] transactions over time” by Arjun Joshua

There’ve already been some good write-ups exploring the output of PaySim, both in terms of the sample dataset posted to Kaggle circa 3 years ago and possible ML-based approaches to fraud detection like those of Arjun Joshua2. Most recently, Sara Robinson3, published an example using TensorFlow and Google’s Cloud AI Platform to build a predictive model.

But, what’s the one thing all the ML-based approaches have in common? They all illustrate critical shortcomings in PaySim, specifically its overly simplistic modeling of a single type of fraud. They all exploit the fact PaySim’s logic for fraudsters is overly simplisitc.

Let’s see if we can improve PaySim and find new ways to identify fraud using graphs with neo4j, shall we?

This is the first post of a few (maybe 3?) that will explore my experimentation and research taking the open-source PaySim project, improving upon it, and integrating it with Neo4j to implement a fraud analytics platform.

Background: A Mobile Money Primer 💸

To understand PaySim, we need to understand a little about what it was built to model, specifically a mobile money network.

Mobile money takes different forms, but in the case of PaySim it involves both Banks and participating Merchants. Merchants can take mobile payments via the network (for goods/services) as well as perform the function of putting money into the network (e.g. “topping up” an account).

If it sounds a lot like Apple Pay, it’s because mobile payment services are effectively a type of mobile money.

The mobile money network used by the PaySim authors comes from an undisclosed African country, which leads me to believe it’s of the sort similar to M-Pesa.

From the M-Pesa Wikipedia page:

M-Pesa is a branchless banking service; M-Pesa customers can deposit and withdraw money from a network of agents that includes airtime resellers and retail outlets acting as banking agents.

So consider it something like Apple Pay, but where you can also make deposits via participating merchants.

An Overview of PaySim

If PaySim models financial transactions, what does it look like and how does it work?

Let’s jump a bit ahead and talk about what PaySim produces with the help of a graph visualization and then dive into the core components of the simulation: Agents and Transactions.

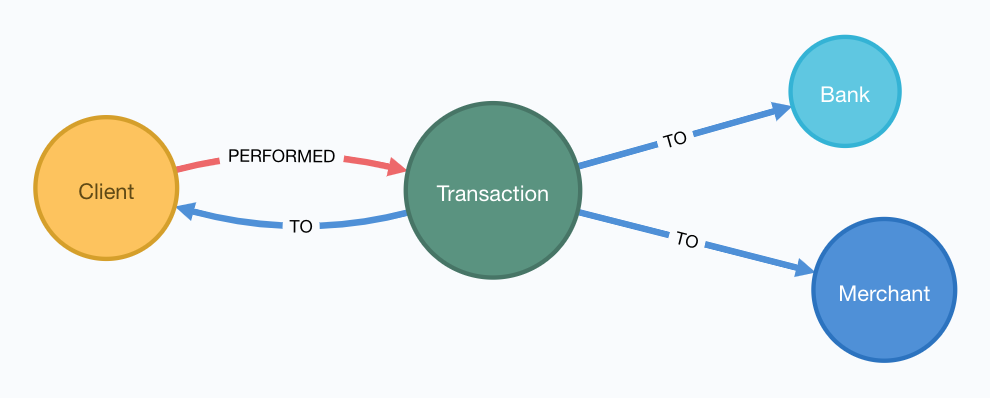

Figure 2: Graphical representation of the PaySim data model

PaySim is a multiagent simulation, that steps through time, where during each step the agents are allowed to act in ways that can change themselves and the rest of the simulation state. If this sounds confusing at first, PaySim functions with a single core axiom:

Clientsperform zero or manyTransactionsat each step in time, exchanging money with other agents in the network, specificallyBanks,Merchants, and otherClients.

Let’s look a bit closer at both the types of Agents and the types of Transactions that PaySim simulates.

Agent Types

Agents are the key actors, meaning they can perform actions in the simulation. There are three (3) primary agent types and a few subtypes as well.

💳 Clients

Clients model the end users in the mobile money network, effectively mapping to unique accounts that, in theory, are controlled by real people. Since Clients model people, and we’re concerned about modeling fraud, it follows that not all people in our simulation behave the same way. (Surprise, surprise!)

- Some clients are Fraudsters and manipulate the network and other clients to their own gain

- Some clients act solely as Mules, a means of moving money around and ultimately out of the network

- Most are clients just behave normally in how they conduct transactions, like good members of the community

🏬 Merchants

Merchants model the vendors or businesses that participate in the network through interactions with Clients.

- Merchants act as a gateway to the network, allowing assets to flow into and out of the network

- Merchants provide goods/services in exchange for money in the network like a traditional vendor

🏦 Banks

Banks are pretty inert in PaySim, acting only as a target for Debit transactions. They appear to play a relatively limited role PaySim, probably due to not being a critical component of the mobile money network PaySim models. (Consider, for example, the point that some mobile money networks exist in a market because its consituents are “under banked.")

The only role Banks play is to facilitate Debit transactions, which seem more to be a debit against a client’s balance in the network as if they’re transfering money back into their actual bank account.

Transactions

Transactions form the cornerstone of PaySim that they’re the only real way client can interact with other agents. In fact, clients are the only agents that perform transactions.

While in the real world a financial transaction could occur initiated by banks, merchants, etc., PaySim focuses entirely on the behavior of the Clients.

What can a Client do each turn in the simulation? They have a choice of five (5) possible transactions:

| Transaction | Description |

|---|---|

| CashIn | A Client moves money into the network via a Merchant |

| CashOut | A Client moves money out of the network via a Merchant |

| Debit | A Client moves money into a Bank |

| Transfer | A Client sends money to another Client |

| Payment | A Client exchanges money for something from a Merchant |

Depending on the type of transaction, certain rules apply:

-

Every transaction must have a second agent of a supported type, dependent on the type of transaction.

-

Only Transfers between clients require proper double-entry bookkeeping where there’s a zero-sum. (Corollary: the simulation’s money supply can be increased/decreased via Merchants and Banks.)

-

Transfers amounts must fall under a global transfer limit set in the simulation parameters prior to simulation start. For larger transfers, they must be broken into multiple transactions.

Step by Step (day by day?)

The last thing to note about PaySim (and then you’ll be a PaySim expert!), is that the simulation runs in discrete steps. At every “step”, each agent (in some deterministic order) gets an opportunity to act.

In the case of PaySim:

- Each “step” corresponds to one (1) hour of time

- Agents, specifically Clients, may act zero or many times per step

- Internal limitations cap PaySim at 720 steps or 30 days of simulated time4

From a code perspective, each agent in the simulation needs to

implement a simple sim.engine.Steppable interface5 that the

simulation will call at each step while providing a reference to the

overall simulation state itself:

/*

Copyright 2006 by Sean Luke and George Mason University

Licensed under the Academic Free License version 3.0

See the file "LICENSE" for more information

*/

package sim.engine;

/** Something that can be stepped */

public interface Steppable extends java.io.Serializable

{

public void step(SimState state);

}

In PaySim, all the clients implement Steppable and provide their own

logic for how they’ll behave.

👷 Improving PaySim

You can run PaySim as-is, out of the box, and generate synthetic data, so why not just use it now to explore fraud and build our graph? Well…it presents a few challenges:

-

PaySim expects to write out simulation results as CSV files. While Neo4j natively supports loading csv6, loading the transactions on the fly would open a lot more possibilities like simulating real-time detection and action.

-

Transactions in PaySim contain only bare bones data, with some critical aspects left to be inferred.

-

PaySim never explicitly documents all the actors in a simulation run, leaving you to infer their details from the raw transaction output. (In the code, however, it does keep track of all agents.)

Since PaySim is open source, I’ve forked the original and all the changes we’ll be walking through will be part of my PaySim 2.1.7

Before we dive in, the changes we want to make fall into two categories:

- improving ergnomics and usability of PaySim, allowing us to enhance it and add new features

- expanding upon the modeling of Fraudsters, incorporating the two common types of fraudsters: 1st and 3rd party

⬆ Code Upgrades

PaySim is provided as a Java application built upon the MASON agent simulation framework8, a mature and proven kitchen-sink multi-agent simulation platform. However, the way PaySim was implemented by the authors makes it challenging to build upon and expand.

Here I’ll provide a high level overview of code improvements in my fork of PaySim available at https://github.com/voutilad/paysim.

If you’re not interested in some of the lower-level code changes, jump ahead to Enhancing PaySim’s Fraudsters.

Making PaySim more of a Library than an App

First up is fixing PaySim’s desire to only output to the file system. There are two primary improvements I made to make PaySim embeddable as a library:

-

Abstracted out the base simulation logic from the orchestration, so the original PaySim can be run writing out to disk, but developers can implement alternative implementations doing whatever they want.

-

Implemented an iterating version of PaySim, allowing an application embedding PaySim to drive the simulation at its own pace and consume data on the fly.

The original PaySim logic is preserved, but the front-end is now

choosable by the developer or end-user. For example, to run something

analagous to the original PaySim project, you can run the main()

method in the OriginalPaySim class and it will write out all the

expected output files to disk.

Figure 3: IteratingPaySim Implementation (high-level)

If instead you want to drive the simulation using an implementation of

a Java Iterator<org.paysim.base.Transaction>, use the

IteratingPaySim class and consume transactions sequentially. A

worker thread drives the simulation in the background while data flows

via an buffered implementation of a java.util.ArrayDeque9. (The

nitty gritty details are beyond the scope of this post at the moment.)

Improving PaySim Transactions & History

This part is a relatively simple change as to keep compatibility with

the original PaySim logic I’ve kept the Transaction implementation

relatively the same, with the key exception of adding in details about

the actor “types” on the sending and receiving end.

Since all actors derive from the org.paysim.actors.SuperActor base

class, they all implement some getter for a SuperActor.Type

value (an enum).

By tracking the SuperActor.Type on the Transaction:

-

We don’t have to keep references to the actors and they can ultimately be garbage collected by the JVM if we destroy the simulation.

-

More importantly, we can always know what type of actors the transaction pertains to, allowing us to accurately look up specific instances either in PaySim’s tracking of Clients/Merchants/Banks or in our resulting database.

Other Miscelanneous Housekeeping

I made various touchups and tweaks that are too in-the-weeds for this blog post, so if you’re interested make sure to check out the project’s README for some more details. Some items of note:

- removed reliance on Java

staticmembers allowing multiple configurations of PaySim to be loaded - reduced MASON’s footprint, removing uneeded features

- incorporated SL4j logging framework, removing reliance on

System.outfor logging

Enhancing PaySim’s Fraudsters

With the foundation improved, we can now work on shoring up the logic for our fraudsters. Let’s first look at how the original PaySim fraudsters behave and then get into the changes for 1st and 3rd Party implementations.

😏 The Original PaySim Fraudster Behavior

PaySim originally only models what looks to be a form of 3rd-party fraud:

- Fraudsters target an established Client account (the victim)

- Fraudsters trigger Transfers from that victim to a Mule account the Fraudster creates

- When the Mule has a certain balance level it performs a

CashOut

A real-world example of this might be someone breaching someone’s mobile money account via credential skimming/theft or phishing. Once the Fraudster has access to the payment card they can cash out by buying gift cards or prepaid cards that can in turn either be used or sold to convert to actual cash.

Can we make it a tad more realistic?

-

Fraudsters try to completely drain a Victim’s account, performing Transfers up to the network “transfer limit” set by the model parameters.

- In real world credit card fraud, cards are usually “tested” through small transactions or pre-authorization before being used for big purchases.

-

A PaySim Fraudster picks a Victim from the simulation universe at random.

- In the real world, while there’s some behavior that may appear random, Fraudsters often breach or compromise a Merchant’s POS systems (both offline and online) to initially gain access to victims’ accounts.

With the above in mind, let’s first talk about turning our generic PaySim fraudster into a 3rd Party Fraudster.

Improving 3rd Party Fraudsters

We’ll enhance our 3rd-party Fraudsters to incorporate a few new behaviors bringing it closer to realistic behavior:

- To simulate merchant breaches, card skimming, etc., support storing “favored” Merchants that the Fraudster will use as a means of targeting Clients for victimization

- Keep track of fraud victims, the easiest target of future fraud

- For new Victims, try making “test charges” simulating real world card testing10

Like the original PaySim, we’ll keep the idea that a 3rd-party Fraudster creates a Mule account as a means of cashing out of the network.

For logic changes, let’s keep it simple but accounting for some key events:

-

Test fraud probability like in original PaySim. If test fails, abort actions for this simulation step.

-

If there are no victims OR we pass a probability check for picking a new victim, we enter New Victim mode:

- Pick a Merchant at random from favored merchants.

- Pick a Client via the Merchant history at random OR if there is no favorted Merchant, pick a random Client from the universe.

- Conduct “Payment” transcations acting as test charges

- If the test charge succeeds (i.e. Victim has non-zero balance), then try performing a “Transfer” of some percentage of the Client balance to a Mule.

-

Otherwise, pick an existing Victim at random and try a “Transfer” of some percentage of the Client balance to a Mule.

See ThirdPartyFraudster.java in the code base for implementation details.

🎭 1st Party (Synthetic) Fraudsters

First Party Fraud typically entails misrepresenting oneself in order to establish a line of credit with no intent to fulfill any debts. (See the definition in Open Risk Manual.)

A more interesting form of fraud is synthetic identity fraud where instead of using their own identifying information, fraudsters mix real with fake identifiers in order to slip past fraud checks when opening accounts or getting credit lines.

Should be easy to add to PaySim, but PaySim doesn’t have any form of identities!

First, we’ll have to bend our definition of the payment network being modeled by PaySim and assume some of it involves lines of credit.

Next, adding identities is pretty easy, but requires a bit of an overhaul across the agent (actor) codebase: we ultimately needs all Clients, whether Fraudsters, Mules, or regular, to have some identifiable details that are generally unique.

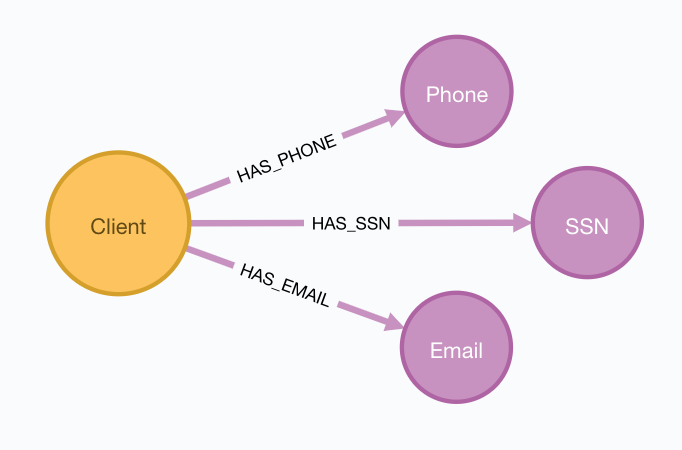

Modeling Identities

What should it look like in the end? From a graph perspective, there’s a pretty trivial way to incorporate identities with Clients: relate each Client to an instance of an Identity.

Figure 4: Pretty simple model: Client’s have one or many identifiers

From the PaySim code perspective, it gets a bit trickier, and easily can turn into a bike shedding exercise. Here’s where I ended up:

-

All

SuperActorinstances (our base actor class) areIdentifiable.- Being

Identifiablemeans you have an “Id” and a “Name” (both Strings) as attributes. - It also means you can provide a reference to an

Identity.

- Being

-

An

Identityeffectively is a container for the different identity attributes (name, id, etc.) and there are multiple implementations:- A

BankIdentityandMerchantIdentityboth only have an “Id” and a “Name”. - A

ClientIdentityis more representitive of a “person”, having not only a “Name” and “Id”, but others like “email”, “ssn”, and “phone” numbers.

- A

-

An

IdentityFactoryprovides a deterministic means of producing “random” identities as needed.- It effectively abstracts a 3rd party library (jFairy) I’m currently using to generate “realistic” people and companies.

- While jFairy uses a different random number generator than the core of PaySim, it can take a seed and produce deterministic results, which is key to keeping PaySim reproducable.

-

Constructors for actors get overhauled to optionally take a reference to an

Identityimplementation OR will generate one if not provided.

PHEW! If you want to look at the code mess, the org.paysim.identity package contains most of the additional code. Also check out some commits like 78b1cfb and f7b174a to see how things were changed.

Building the 1st Party Fraudster

Now that we have an identity component to our actors, let’s put together a new fraudster.

Using security breaches and identity theft stories from the headlines, let’s pretend our fraudster acquired some number of viable identities (names, ssn’s, and phone numbers). When we create a 1st-party fraudster, we can generate a handful of identities and give them to the fraudster.

For committing the fraud, we’ll start with a pretty trivial implementation:

- Do a fraud probability check to see if we continue or skip running during this simulation step.

- Generate a “new” identity, composing parts from our “stolen” identities.

- Create the new client account using the identity.

- Drain whatever starting balance was given to the new account, transferring its balance to the fraudster’s designated Mule.

- Profit.

From a Java implementation standpoint11, it’s pretty short and sweet:

@Override

public void step(SimState state) {

PaySimState paysim = (PaySimState) state;

final int step = (int) state.schedule.getSteps();

if (paysim.getRNG().nextDouble() < parameters.fraudProbability) {

ClientIdentity fauxIdentity = composeNewIdentity(paysim);

Mule m = new Mule(paysim, fauxIdentity);

Transaction drain = m.handleTransfer(cashoutMule, step, m.balance);

fauxAccounts.add(m);

paysim.addClient(m);

paysim.onTransactions(Arrays.asList(drain));

}

}

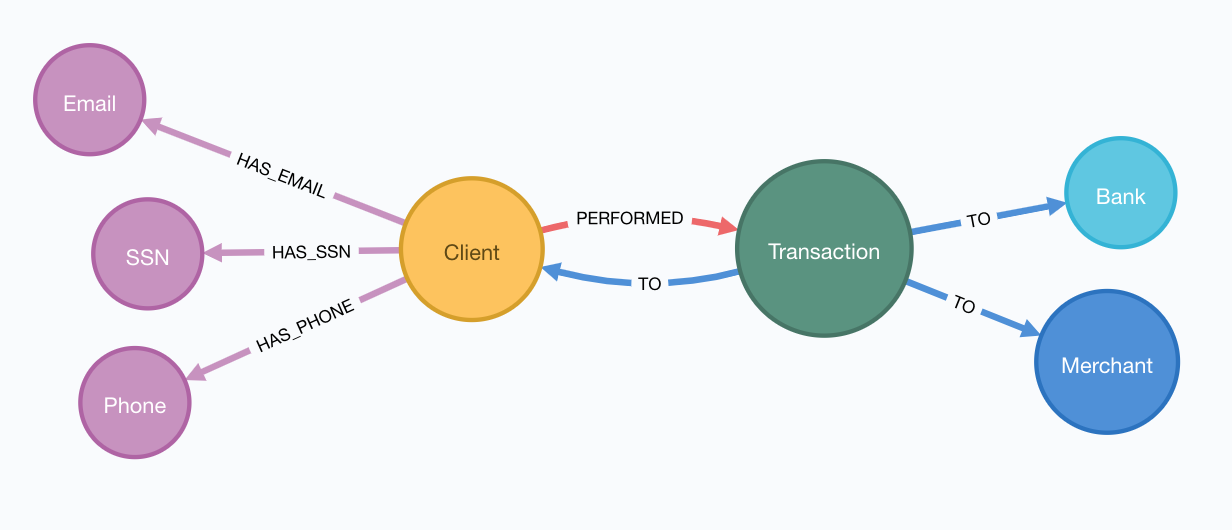

Our Journey So Far

At this point, we’ve got a revamped, new version of PaySim that can be run standalone or embedded. We’ve also got an understanding of our data model and how we plan on adapting it to our graph model, laying the foundation. Our data model is also slightly different.

Figure 5: Our Updated PaySim 2.1 Data Model

You’ll notice that unlike what we started with, it now provides

identifiers (e.g. Phone, Email, SSN) for each Client account

(which may or may not be a Mule).

Other enhancements in PaySim 2.1 not visible in the data model:

- Fraudsters now come in two flavors: 1st and 3rd Party

- 1st Party now use identifiers to create clients they control

- 3rd Party now attack clients via merchant connections

- Clients become more exposed to fraud risk if they conduct transactions with targeted merchants

To me this feels like an improvement. Let’s now put it to work and simulate some fraud!

Next Episode: Getting PaySim Transactions into Neo4j

In my next post, we’ll look at how to configure and run a PaySim simulation while simultaneously bulk loading the transaction output into a live Neo4j instance. We’ll cover:

- Leveraging the Neo4j Java Driver12 to load PaySim Transactions on-the-fly as the simulation runs

- Best practices for batch/bulk data loading to get high throughput on database writes

- How to threading transactions into event chains and why that’s helpful for downline analysis

A final post (TBA) will dive into how to analyze the data from both a visual perspective as well as an algorithmic approach using Neo4j’s Graph Algorithms library.

Until next time! 👋

-

PaySim:A Financial Mobile Money Simulator For Fraud Detection ↩︎

-

See Arjun’s Kaggle notebook here: https://www.kaggle.com/arjunjoshua/predicting-fraud-in-financial-payment-services ↩︎

-

Sara is a Developer Advocate for Google Cloud. You can find her blog at https://sararobinson.dev/ ↩︎

-

This is due to PaySim using aggregate data to drive the simulation and the data provided (by the original authors) only covers 30 days. Modifying this data will allow PaySim to produce different outcomes of differing lengths. ↩︎

-

https://github.com/voutilad/mason/blob/728bdc43f35dd52c06ffce99a704f3191c2fcfa4/mason/src/main/java/sim/engine/Steppable.java ↩︎

-

As such, PaySim is provided under the GPLv3 and my fork is available at https://github.com/voutilad/PaySim. ↩︎

-

See the MASON project’s home page: https://cs.gmu.edu/~eclab/projects/mason/ ↩︎

-

https://docs.oracle.com/javase/8/docs/api/java/util/ArrayDeque.html ↩︎

-

See Stripe’s docs on how they define “card testing” https://stripe.com/docs/card-testing ↩︎

-

https://github.com/voutilad/PaySim/blob/3cfb56d0d52e45157f387144e8a4d0be7bcb7850/src/main/java/org/paysim/actors/FirstPartyFraudster.java#L44 ↩︎