If you’ve followed along in the PaySim series of posts or at least discovered the demo project, you’ve now got a graph representing 30 days of financial transactions in a simulated financial network running inside your Neo4j 3.5 database.

Somewhere in that haystack are our fraudsters we created previously, or at least the result of their malicious behavior.

The question is: How can we leverage the fact we’ve built a graph to rapidly identify potential first party fraudsters?

Looking for previous posts? See part 1 to learn about PaySim and part 2 to learn about integrating it with Neo4j.

For instructions on installing Neo4j’s Graph Data Science library, see the documentation here.

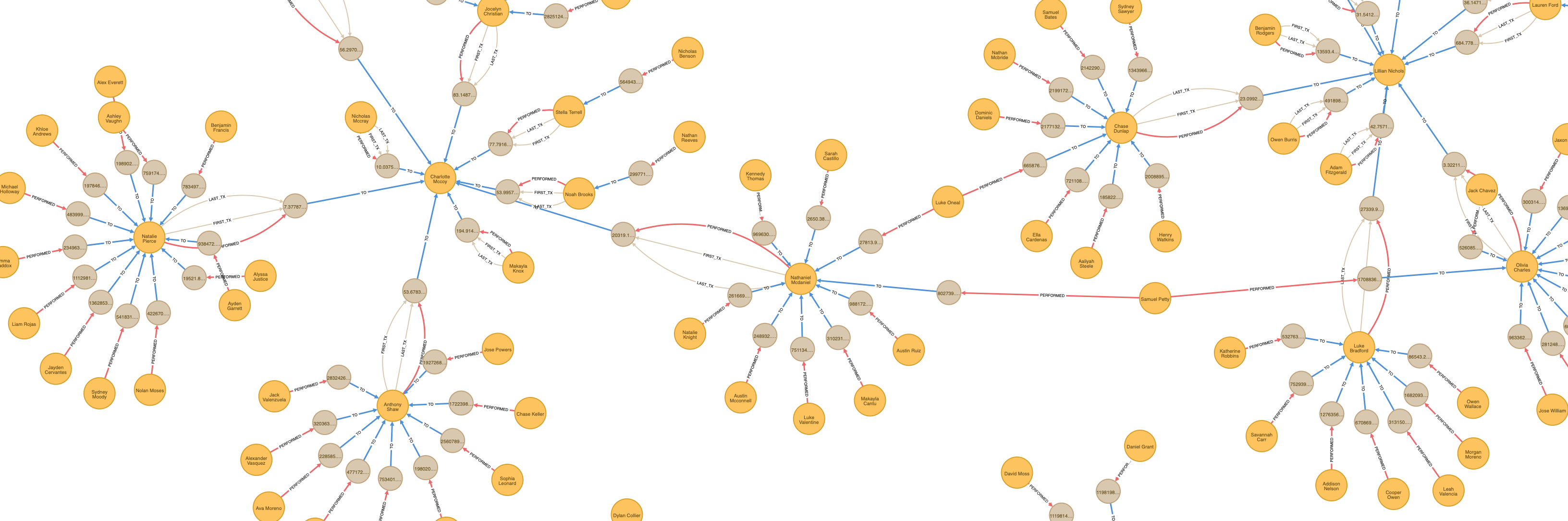

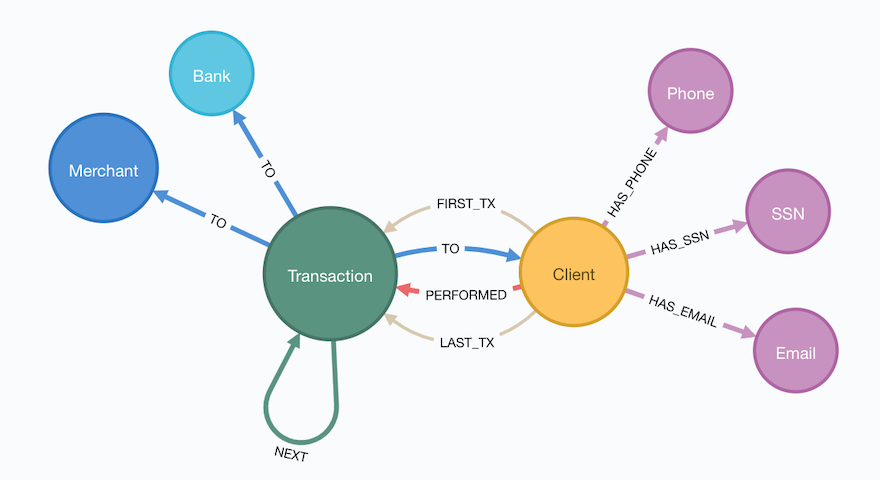

What’s our Graph look like again?

Before we dig into our methodology and look at some queries, let’s first recap and look at the graph we built and loaded in Part 2.

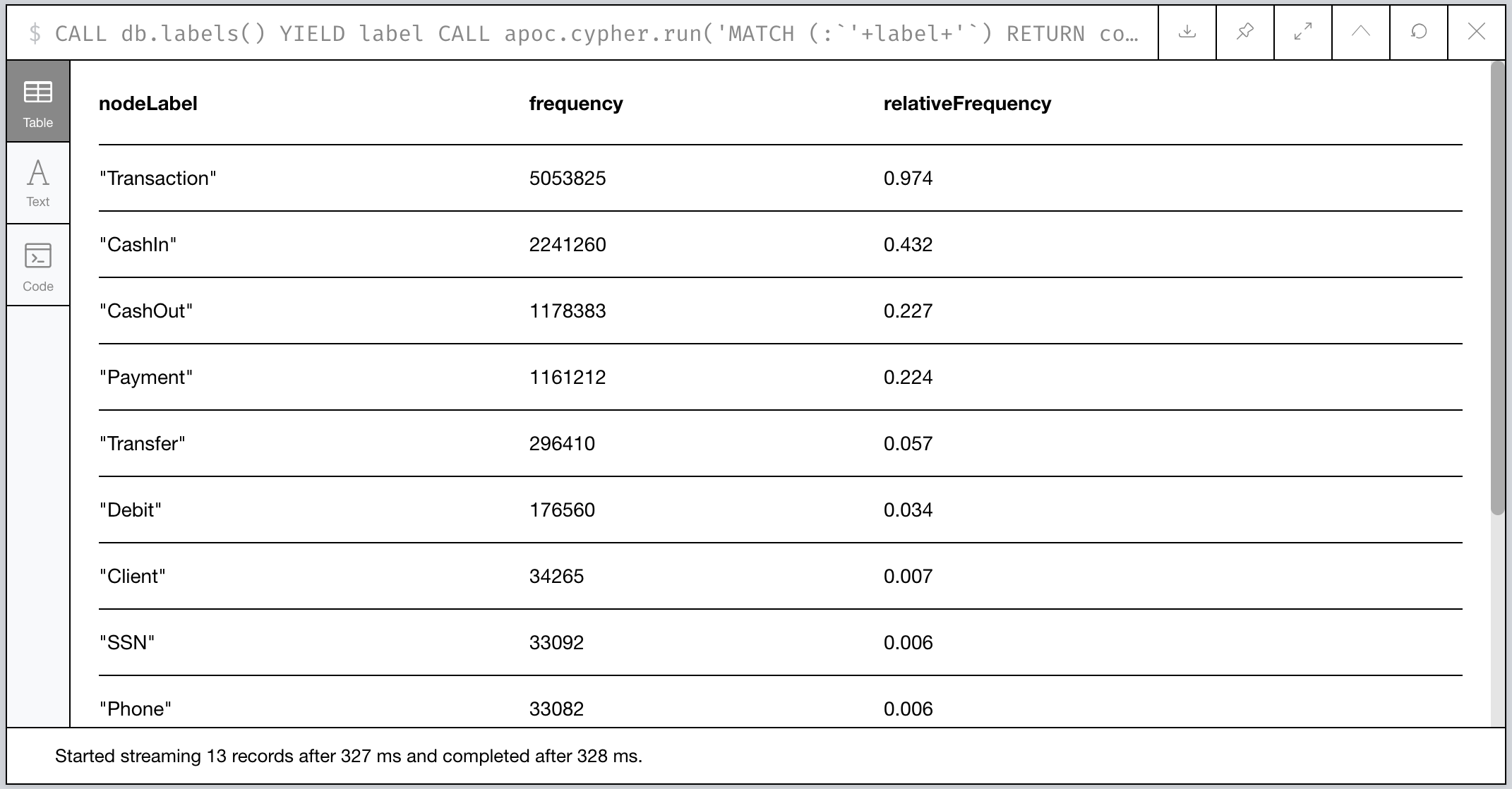

Now that’s just the schema of our graph, but what are defining characteristics of our data? We can use a mix of Cypher and helper procedures from APOC to profile our graph.

CALL db.labels() YIELD label

CALL apoc.cypher.run('MATCH (:`'+label+'`) RETURN count(*) as freq',{}) YIELD value

WITH label,value.freq AS freq

CALL apoc.meta.stats() YIELD nodeCount

WITH *, 10^3 AS scaleFactor, toFloat(freq)/toFloat(nodeCount) AS relFreq

RETURN label AS nodeLabel,

freq AS frequency,

round(relFreq*scaleFactor)/scaleFactor AS relativeFrequency

ORDER BY freq DESC

The above Cypher will:

- interrogate the database to get all known labels (e.g. Client, Transaction, etc.)

- Run a sub-query using APOC to get label counts

- Analyze the label counts against the global label counts

Figure 1: Relative Frequency of Labels in our PaySim Graph

So most (62%) of our transaction activity is some form of

ingress/egress where money flows into and out of the network via

CashIn=/=CashOut transactions. The remaining 38% of activity

involves money flowing to and from parties in the network.

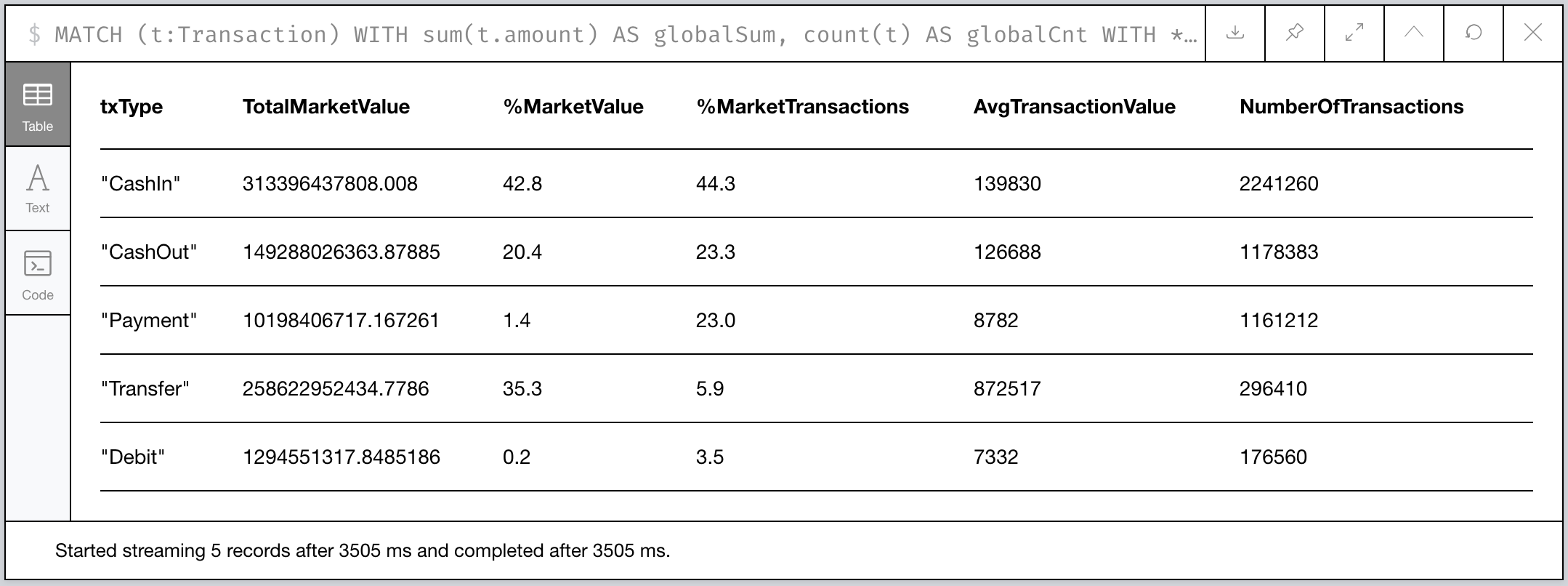

Is there anything interesting about the transactions themselves?

Let’s take a look.

// Get the total number of transactions in count, value, and frequency

MATCH (t:Transaction)

WITH sum(t.amount) AS globalSum, count(t) AS globalCnt

WITH *, 10^3 AS scaleFactor

UNWIND ['CashIn', 'CashOut', 'Payment', 'Debit', 'Transfer'] AS txType

CALL apoc.cypher.run('MATCH (t:' + txType + ') RETURN sum(t.amount) as txAmount, count(t) AS txCnt', {}) YIELD value

RETURN txType,

value.txAmount AS TotalMarketValue,

100 * round(scaleFactor * (toFloat(value.txAmount) / toFloat(globalSum)))/scaleFactor AS `%MarketValue`,

100 * round(scaleFactor * (toFloat(value.txCnt) / toFloat(globalCnt)))/scaleFactor AS `%MarketTransactions`,

toInteger(toFloat(value.txAmount) / toFloat(value.txCnt)) AS AvgTransactionValue,

value.txCnt AS NumberOfTransactions

ORDER BY `%MarketTransactions` DESC

The above Cypher performs a pretty basic aggregation of the number of transactions by type, the total monetary value, and the average value of each transaction.

Figure 2: Aggregate Transaction statistical profile

The CashIn transactions still dominate in terms of quantity and

average transaction size, but interestingly Transfer transactions

make up over a 1/3rd of the total market activity in terms the amount

of money involved even though they’re hardly 6% of the total

transaction volume. In fact, the average Transfer involves funds

6.25 times the average CashIn transaction!!

What does this mean? 🧐

Money is passed around in large quantities more than its injected into or removed from the network.1

Given that fact, we’ll probably see something interesting when we look at transfers of money between Clients!

Finding our First Party Fraud

Recall that First Party Fraud is a form of identity fraud where the fraudster either uses either fully synthetic (fake) identifiers or steals and uses real identifiers in order to build up some account standing (e.g. credit rating or credit line) before “busting out” and draining the account into something liquid they can run away with.

In our PaySim version, we’ve constructed 1st Party Fraudsters that

generate pools of identifiers like Emails, SSNs, and Phone

Numbers that they remix into different (ideally unique) combinations

when creating a client in our network. Then at some time in the

future, they drain those accounts via an intermediary (a mule) and

conduct a CashOut to exfiltrate the money from our network.

Our methodology for finding these fraudulent accounts will be as follows:

- Cull the universe down to potentially fruadulent accounts using community detect methods.

- Quantify and filter community members based on similarity.

- Identify hot spots (possible initial sources of fraud) using centralitiy measurements.

- Visualize the subgraph to illustrate the impact and any anomalies.

Filtering the Universe with Weakly Connected Components

Our first step leverages the connectedness of our graph and looks for PaySim Clients that share identifiers. Since when we loaded our data in part 2 creating unique nodes for each instance of an identifier (e.g. there’s only one SSN of 123-45-6789), it’s almost trivial to find Clients that share identifiers.

The Weakly Connected Components algorithm analyzes the graph and identifies “graph components”. A component is a set of nodes and relationships where you can reach each member (node) from any other through traversal. It’s called “weakly” since we don’t account for the directionality of relationships.

Connected component algorithms are a type of community detection algorithm. They’re great for understanding the structure of a graph.

Figure 3: “A graph with three components” by David Eppstein (Public Domain, Wikipedia, 2007)

The net result: the algorithm identifies all the possible subgraphs of Clients that have some identifiers in common.

Sounds almost too easy, right? In practice, it’s not uncommon for identifiers to be shared among accounts. A simple example is a shared mailing address for roommates or family members. In real world fraud detection methologies, identifiers tend to be weighted differently.

Create our WCC Projection

Since we don’t care about all nodes and relationships for our WCC approach, we can keep our algorithm focused on just a subgraph and load it into memory.2

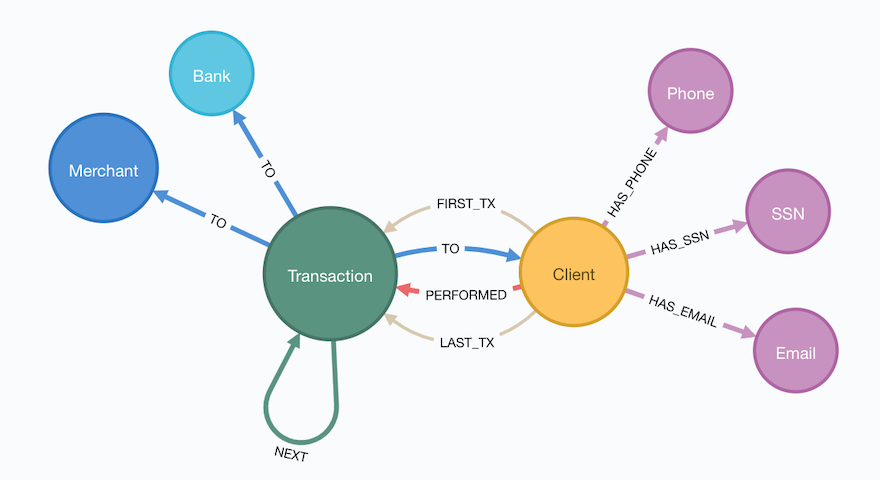

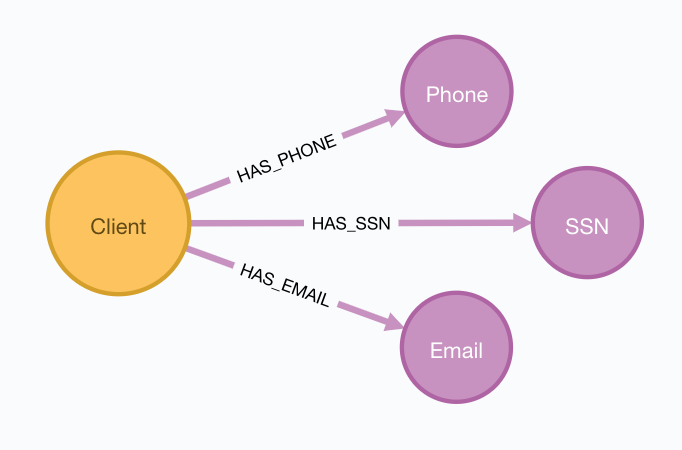

Recall our data model we built out in part 1:

Figure 4: The PaySim 2.1 Data Model

In our case, we’re concerned about only 4 label types:

- Client which is our account/account holder

- SSN which is like a US social security number (or Canadian SNI, etc.)

- Email which should be an email address

- Phone which represents someone’s contact phone number

And we only need the relationships that connect nodes of the above labels: HAS_SSN, HAS_EMAIL, HAS_PHONE.

So let’s target the following subgraph:

Figure 5: Just our Identifiers in PaySim 2.1

We’ll use the gds.graph.create3 stored procedure and lists of Labels

and Relationships of the part of the graph we want to analyze.

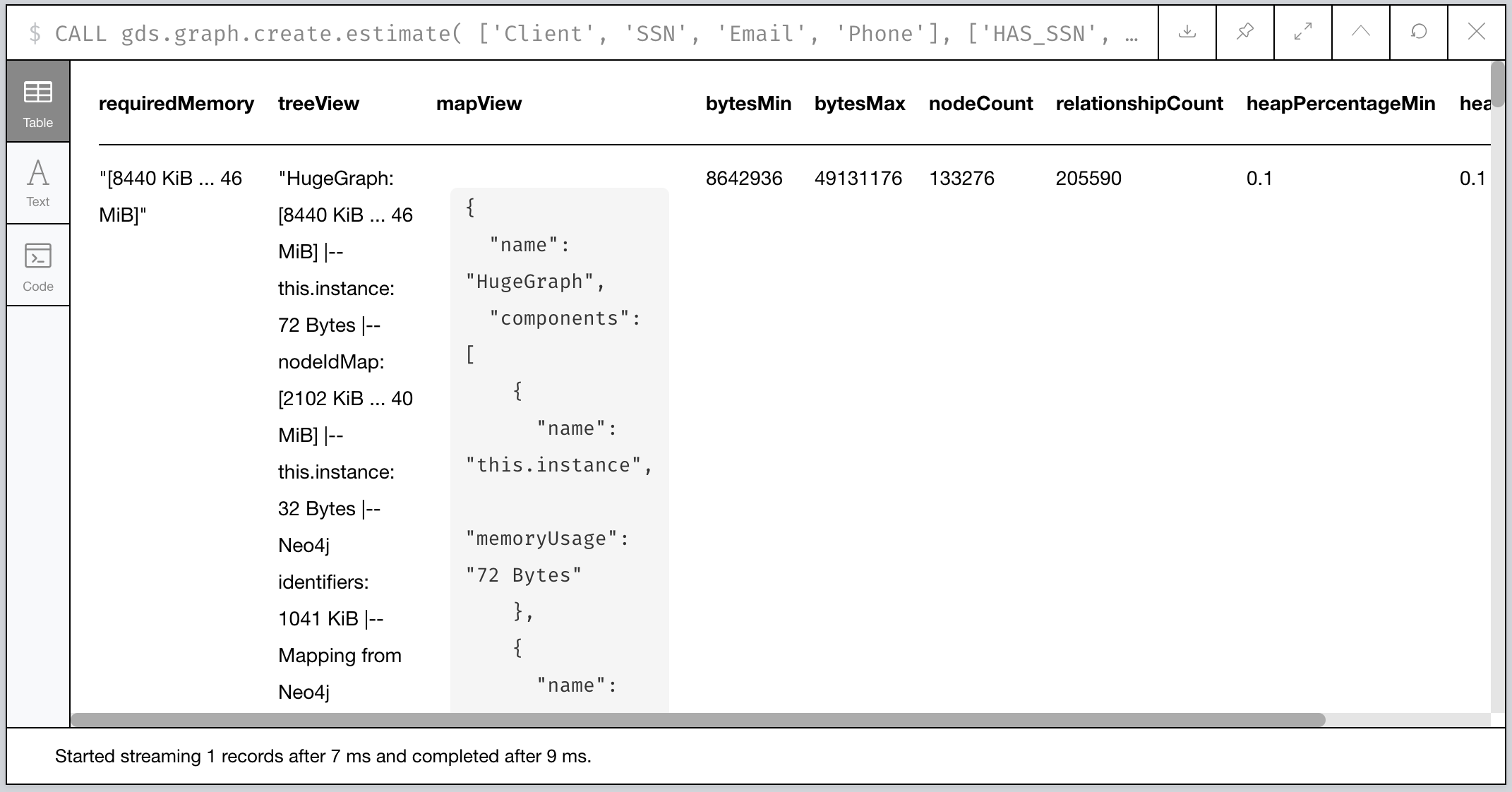

First, let’s estimate how much memory our projection will consume.

CALL gds.graph.create.estimate(

['Client', 'SSN', 'Email', 'Phone'],

['HAS_SSN', 'HAS_EMAIL', 'HAS_PHONE'])

Figure 6: Our estimate for our Graph Projection

According to the requiredMemory output, it looks like we’ll need

about 8-46 megabytes…pretty small! Why is that? We’re focusing only

on Clients and their identifiers, which comprise only ~1-2% of our

total database in terms of nodes. (Recall we analyzed that earlier in

this post.)

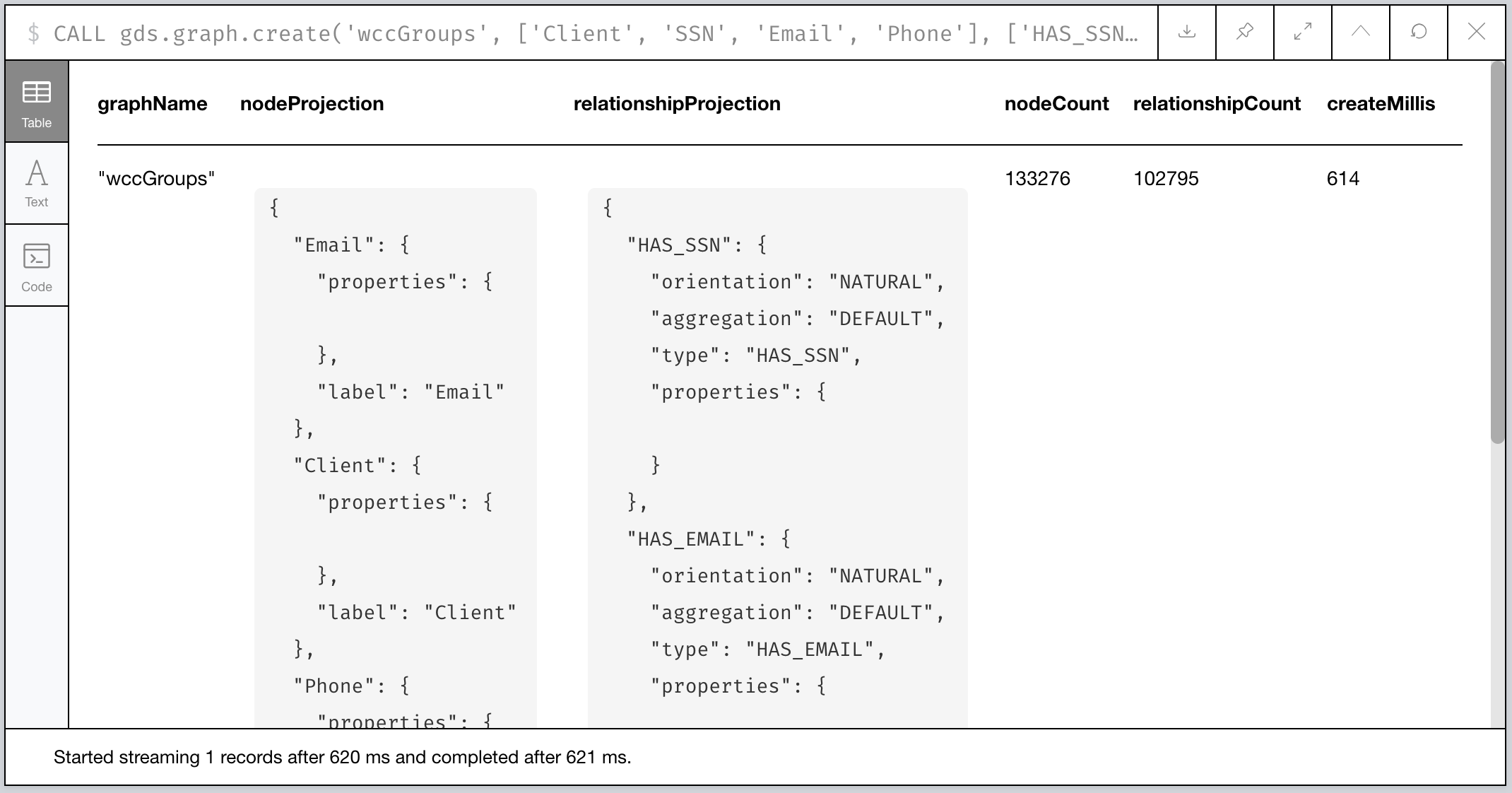

Ok, let’s create the projection now. You’ll notice the stored procedure call is similar, but now we also give it a name we’ll use to refer to the projection later:

// Create our projection called "wccGroups"

CALL gds.graph.create('wccGroups',

['Client', 'SSN', 'Email', 'Phone'],

['HAS_SSN', 'HAS_EMAIL', 'HAS_PHONE'])

You should see some metadata output telling you some details about the type and size of the graph projection. It’ll detail how many relationships and nodes were processed plus some other facts.

Figure 7: Our “wccGroups” graph projection output

Easy, peasy! Let’s get on with running the algorithm…

Compute and tag our WCC groups

With the subgraph loaded, we can simply let the algorithm do its thing. In the interest of learning and sanity checking our work, let’s first look at the algorithm output before we go much further.

The algorithm is accessed via the gds.wcc.stream stored procedure

call and it provides as output the internal id of a given node

(nodeId) and the component it’s a part of (componentId). We’ll use

the utility function gds.util.asNode() to fetch the underlying Node

instance by its internal id and then analyze our groupings:

// Call the WCC algorithm using our native graph projection

CALL gds.wcc.stream('wccGroups') YIELD nodeId, componentId

// Fetch the Node instance from the db and use its PaySim id

WITH componentId, collect(gds.util.asNode(nodeId).id) AS clients

// Identify groups where there are at least 2 clients

WITH *, size(clients) as groupSize WHERE groupSize > 1

RETURN * ORDER BY groupSize DESC LIMIT 1000

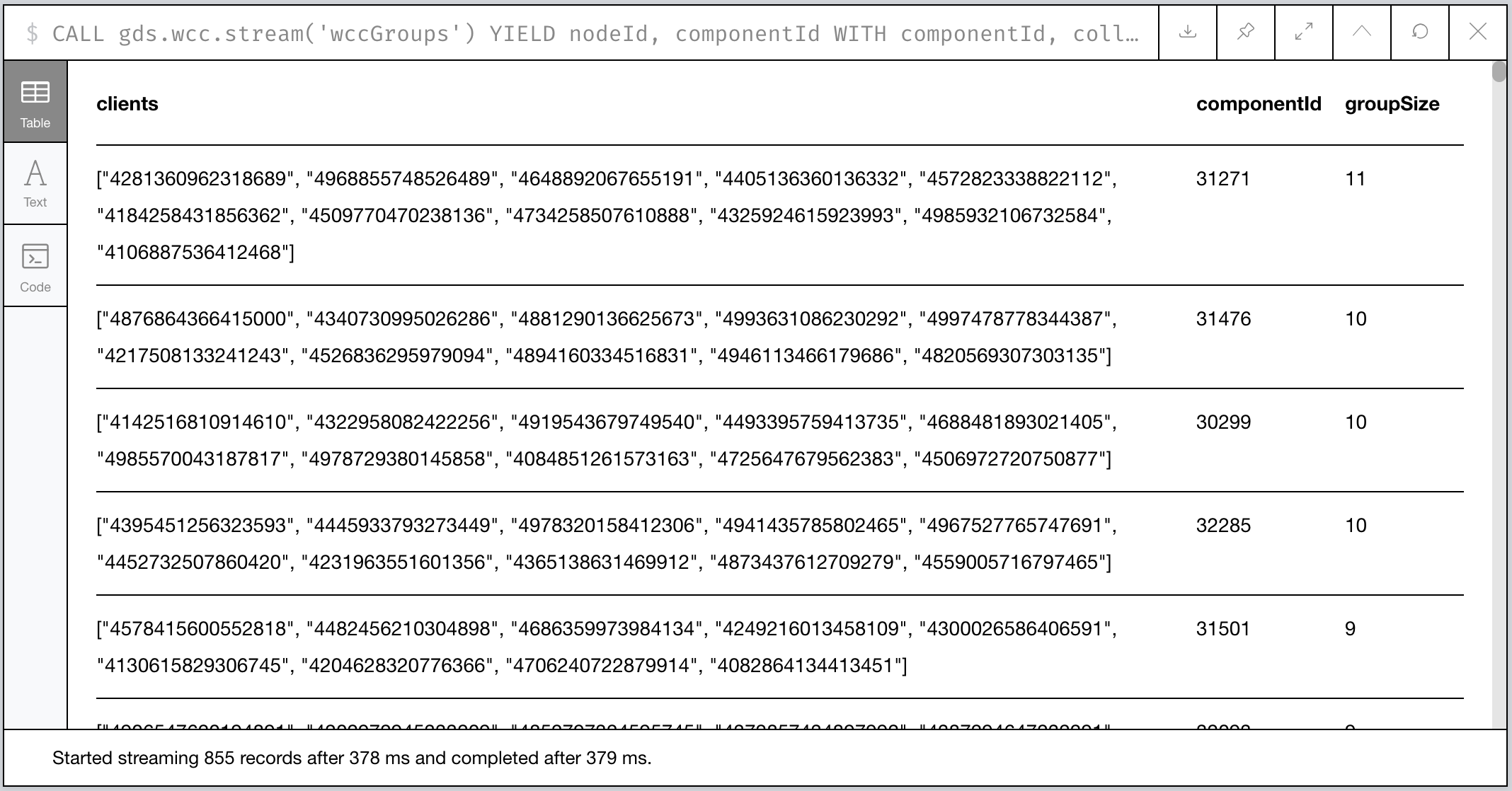

Scanning the results, we have a few large clusters and a lot of small clusters. Those large clusters will probably be of interest and we’ll come back to that shortly.

Figure 8: Our largest graph Components per WCC

Now let’s re-run the algorithm and tag our groups!

We’ll give each matching Client node a new property we’ll call

fraud_group and assign the componentId generated by the

algorithm. This will let us recall the groups at will via basic Cypher

against the core database.

// Call the WCC algorithm using our native graph projection

CALL gds.wcc.stream('wccGroups') YIELD nodeId, componentId

// Fetch the Node instance from the db and use its PaySim id

WITH componentId, collect(gds.util.asNode(nodeId).id) AS clientIds

WITH *, size(clientIds) AS groupSize WHERE groupSize > 1

// Note that in this case, clients is a list of paysim ids.

// Let's unwind the list, MATCH, and tag them individually.

UNWIND clientIds AS clientId

MATCH (c:Client {id:clientId})

SET c.fraud_group = componentId

For good measure, you should index the fraud_group property for

faster recall. Let’s do that.

CREATE INDEX ON :Client(fraud_group)

Sanity Checking WCC’s Output

Lastly, let’s sanity check our results. A few queries ago we only

glanced at the output, but now that we have groups tagged in our

database and the fraud_group property indexed, let’s take a deeper

look at how the communities shake out.

// MATCH only our tagged Clients and group them by group size

MATCH (c:Client) WHERE c.fraud_group IS NOT NULL

WITH c.fraud_group AS groupId, collect(c.id) AS members

WITH groupId, size(members) AS groupSize

WITH collect(groupId) AS groupsOfSize, groupSize

RETURN groupSize,

size(groupsOfSize) AS numOfGroups

ORDER BY groupSize DESC

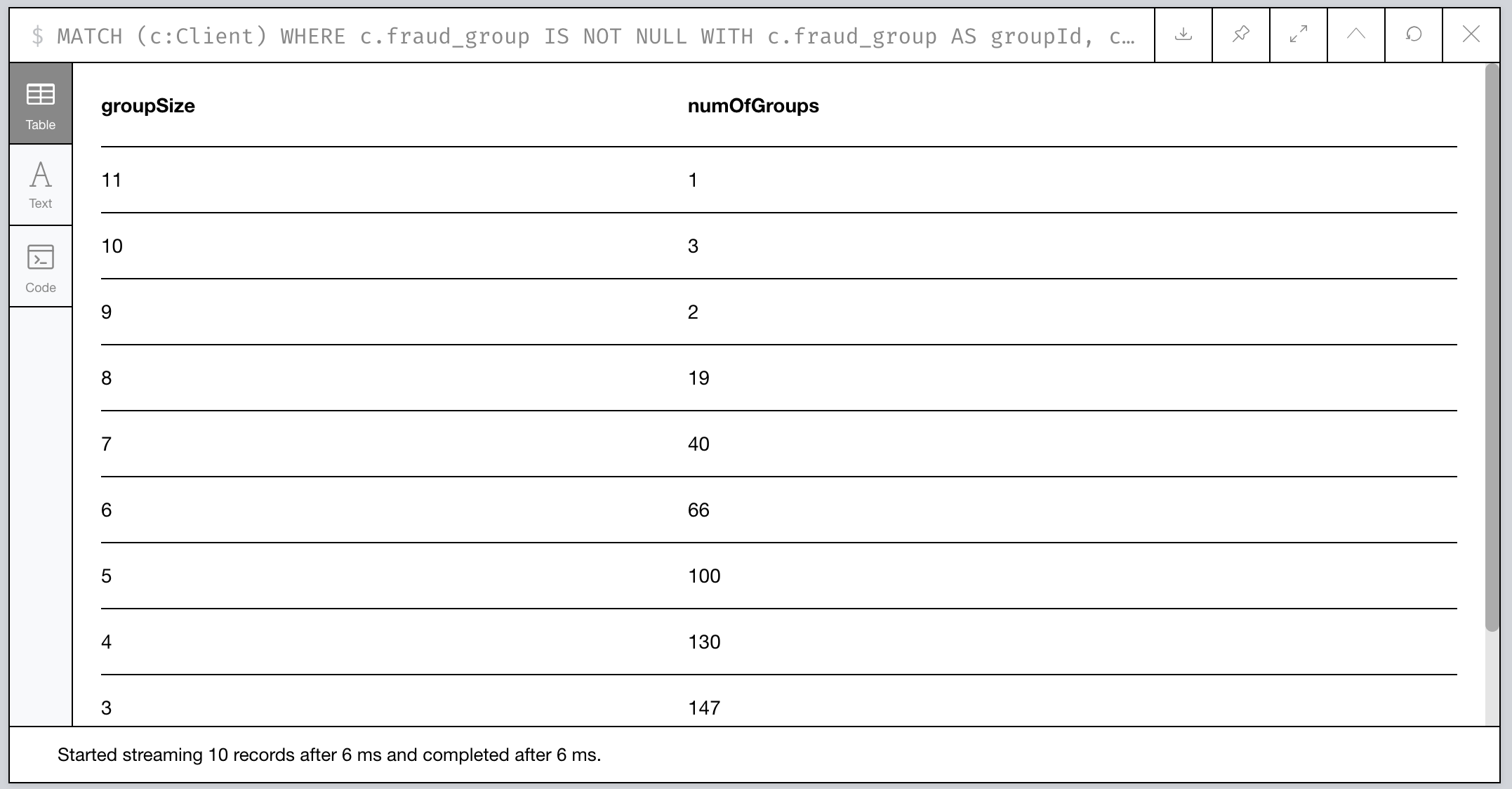

What’s the data look like?

Figure 9: Histogram of Group Size

Ok, wow. Seems most of the communities are pretty small with only 2-3 members, but we have some clear anomalies where 6 groups have community sizes of 9 or more. Something fishy has to be going on with them!

Let’s take a look at them…

// Visualize the larger likely-fraudulent groups

MATCH (c:Client) WHERE c.fraud_group IS NOT NULL

WITH c.fraud_group AS groupId, collect(c.id) AS members

WITH *, size(members) AS groupSize WHERE groupSize > 8

MATCH p=(c:Client {fraud_group:groupId})-[:HAS_SSN|HAS_EMAIL|HAS_PHONE]->()

RETURN p

Figure 10: Our Fraud Groups (of size > 8)

Our six graph components contain a handful of Clients (nodes in yellow) that appear to share identifiers like SSN, Email, and Phone numbers (the nodes in the purplish color).

Analyzing our Suspicious Groups

Now that we’ve identified Client members of some suspicious groups, what if we look at the other Clients outside the group they’ve transacted with?

Maybe we can find something about the true extent of these fraud networks!

Looking at who interacts with our Fraud Groups

Let’s use a simple cypher query to figure out who our fraud groups interact with, maybe there’s something we can learn.

// Recall our tagged Clients and group them by group size

MATCH (c:Client) WHERE c.fraud_group IS NOT NULL

WITH c.fraud_group AS groupId, collect(c.id) AS members

WITH groupId, size(members) AS groupSize WHERE groupSize > 8

// Expand our search to Clients one Transaction away

MATCH p=(:Client {fraud_group:groupId})-[]-(:Transaction)-[]-(c:Client)

WHERE c.fraud_group IS NULL

RETURN p

Figure 11: External Transactions with our Large Fraud Groups

Now that’s something…it looks like what we thought were 6 distinct groups might actually be less. One in particular (at the top of the visualization) seems to be a very expansive network with numerous Clients involved.

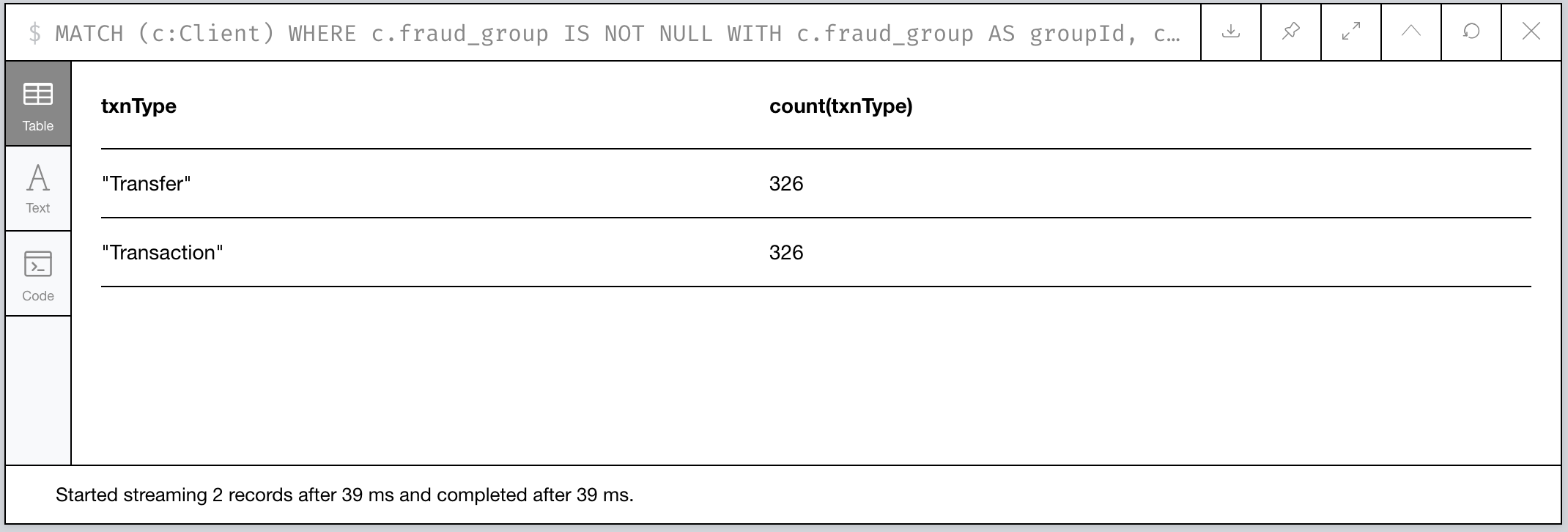

Let’s do some quick analysis and see what types of Transactions occur between these Clients. With a slight tweak to the query, we can perform some aggregate reporting:

// Recall our tagged Clients and group them by group size

MATCH (c:Client) WHERE c.fraud_group IS NOT NULL

WITH c.fraud_group AS groupId, collect(c.id) AS members

WITH groupId, size(members) AS groupSize WHERE groupSize > 8

// Build our network as before

MATCH (:Client {fraud_group:groupId})-[]-(txn:Transaction)-[]-(c:Client)

WHERE c.fraud_group IS NULL

// Since our PaySim demo stacks labels, let's look at our txn reference

UNWIND labels(txn) AS txnType

RETURN distinct(txnType), count(txnType)

Figure 12: An Analysis of Transactions between our Fraud Groups and Others

WOW! All the transactions that connect other Clients to our fraud groups are all Transfers. Kinda fishy!

Connecting our new 2nd-level Fraud groups

We’ve now identified four potential fraud rings. Let’s tag them and relate them to one another to make further analysis easier.

We’ll simplify how our suspect Clients relate to one another

connecting them via direct TRANSACTED_WITH relationships if they’ve

performed a Transaction with one another:

// Recall our tagged Clients and group them by group size

MATCH (c:Client) WHERE c.fraud_group IS NOT NULL

WITH c.fraud_group AS groupId, collect(c.id) AS members

WITH groupId, size(members) AS groupSize WHERE groupSize > 8

// Expand our search to Clients one Transaction away

MATCH (c1:Client {fraud_group:groupId})-[]-(t:Transaction)-[]-(c2:Client)

WHERE c2.fraud_group IS NULL

// Set these Clients as suspects for easier recall

SET c1.suspect = true, c2.suspect = true

// Merge a relationship directly between Clients and copy some

// of the Transaction properties over in case we need them.

MERGE (c1)-[r:TRANSACTED_WITH]->(c2)

ON CREATE SET r += t

RETURN count(r)

Note: We’ll ignore trying to preserve the directionality of the original Transaction. That’s a lesson left to the reader. 😉

Now how do our simplified 2nd-level groups look?

Figure 13: Our 2nd-Level Fraud Groups

WCC Redux: Quickly identify our new Groupings

We’ll use the WCC algorithm again to tag members of each of the groups, but unlike before we’ll use what’s called a cypher projection4 to define how we’ll target a subgraph.

Plus, since this is a pretty small projection (only a few hundred

nodes), we’ll forego creating a named projection and just run it on

the fly! This time we’ll use the gds.wcc.write procedure that will

run the WCC algorithm and tag our members for us, making this pretty

trivial.

You may wonder, why didn’t we use this procedure before instead of the

gds.wcc.streamprocedure? Well, last time we didn’t want to deal with components with only a single Client because they’re not very suspicicous in our case.

Run the following:

// We now use Cypher to target our Nodes and Relationships for input.

// Note how for relationships, the algorithm just wants to know which

// node relates to another and doesn't actually care about the type!

CALL gds.wcc.write({

writeProperty: 'fraud_group_2',

nodeQuery: 'MATCH (c:Client {suspect:true}) RETURN id(c) AS id',

relationshipQuery: 'MATCH (c1:Client {suspect:true})-[r:TRANSACTED_WITH]->(c2:Client)

RETURN id(c1) AS source, id(c2) as target'

})

And like before, we’ll index our new property for faster retrieval:

CREATE INDEX ON :Client(fraud_group_2)

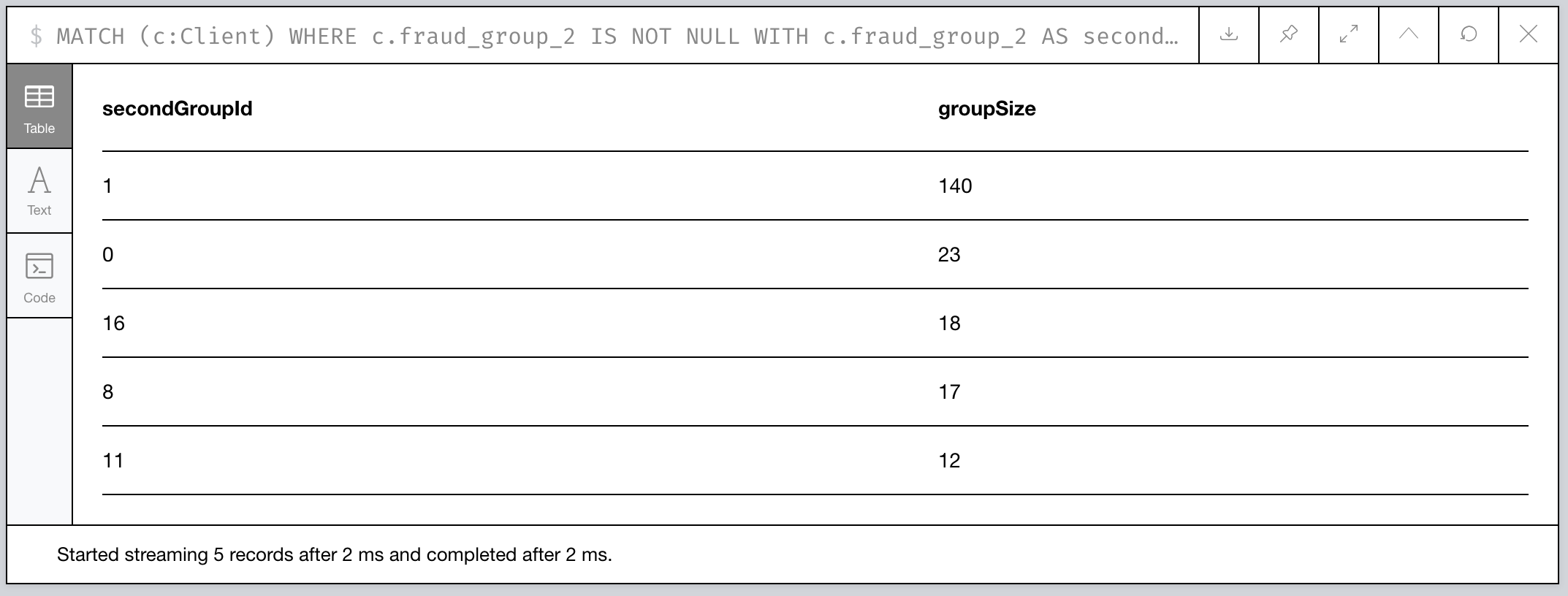

Now let’s analyze our new groups and their memberships:

// Recall our tagged Clients and group them by group size

MATCH (c:Client) WHERE c.fraud_group_2 IS NOT NULL

WITH c.fraud_group_2 AS secondGroupId, collect(c.id) AS members

RETURN secondGroupId, size(members) AS groupSize

ORDER BY groupSize DESC

Figure 14: How large are our 2nd Level Fraud Groups?

It looks like the second-level group with id 1 is MASSIVE compared

to the others! Probably a high-value fraud ring we can try breaking up.

Quantitatively Identifying Suspects

First thing we can do is use our eyeballs and our intuition. Graphs make it easy for humans to start asking questions because we’re glorified pattern recognition biocomputers doing it since birth using any of our senses as input.

But how can we do this algorithmically?

Who are our likely Suspects?

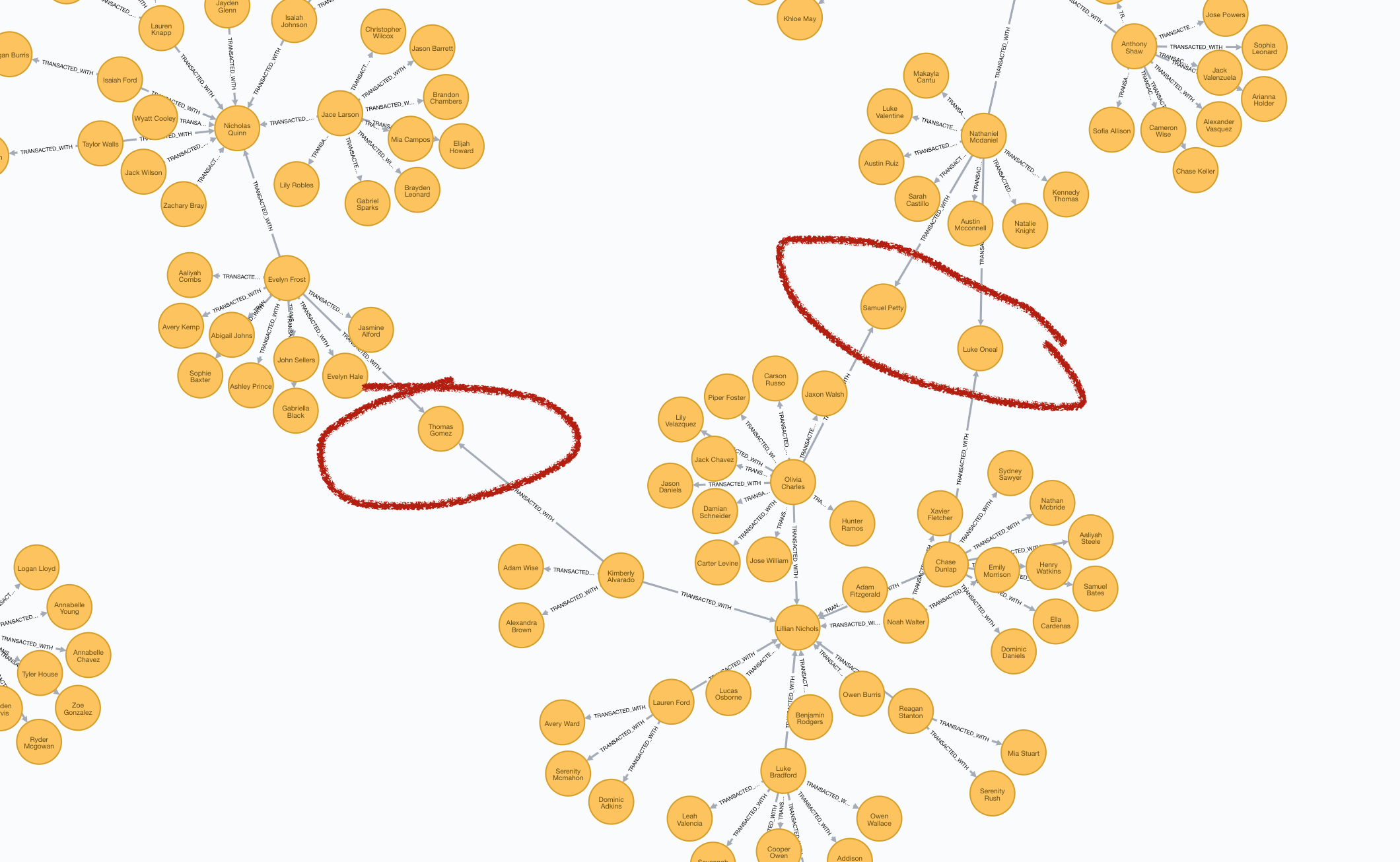

Let’s say we want to tackle that massive 140 Client potential fraud ring. Looking at the graph visually, there appear to be 3 Client accounts that tie the whole thing together:

Figure 15: Our potential Targets

How can we programmatically target Thomas Gomez, Samuel Petty, and

Luke Oneal?

Computing Betweenness Centrality

Another algorithm we can leverage is called Betweenness Centrality.5 From the documentation:

Betweenness centrality is a way of detecting the amount of influence a node has over the flow of information in a graph. It is often used to find nodes that serve as a bridge from one part of a graph to another.

Sounds like a great fit! Let’s try it out.

// Target just our largest fraud group (group 1) using a Cypher projection

CALL gds.alpha.betweenness.stream({

nodeQuery: 'MATCH (c:Client {fraud_group_2:1}) RETURN id(c) AS id',

relationshipQuery: 'MATCH (c1:Client)-[:TRANSACTED_WITH]-(c2:Client)

RETURN id(c1) AS source, id(c2) AS target'

}) YIELD nodeId, centrality

// Fetch the node and also filter out nodes with scores of 0

WITH gds.util.asNode(nodeId) AS c, centrality WHERE centrality > 0

// Return the name and order by score

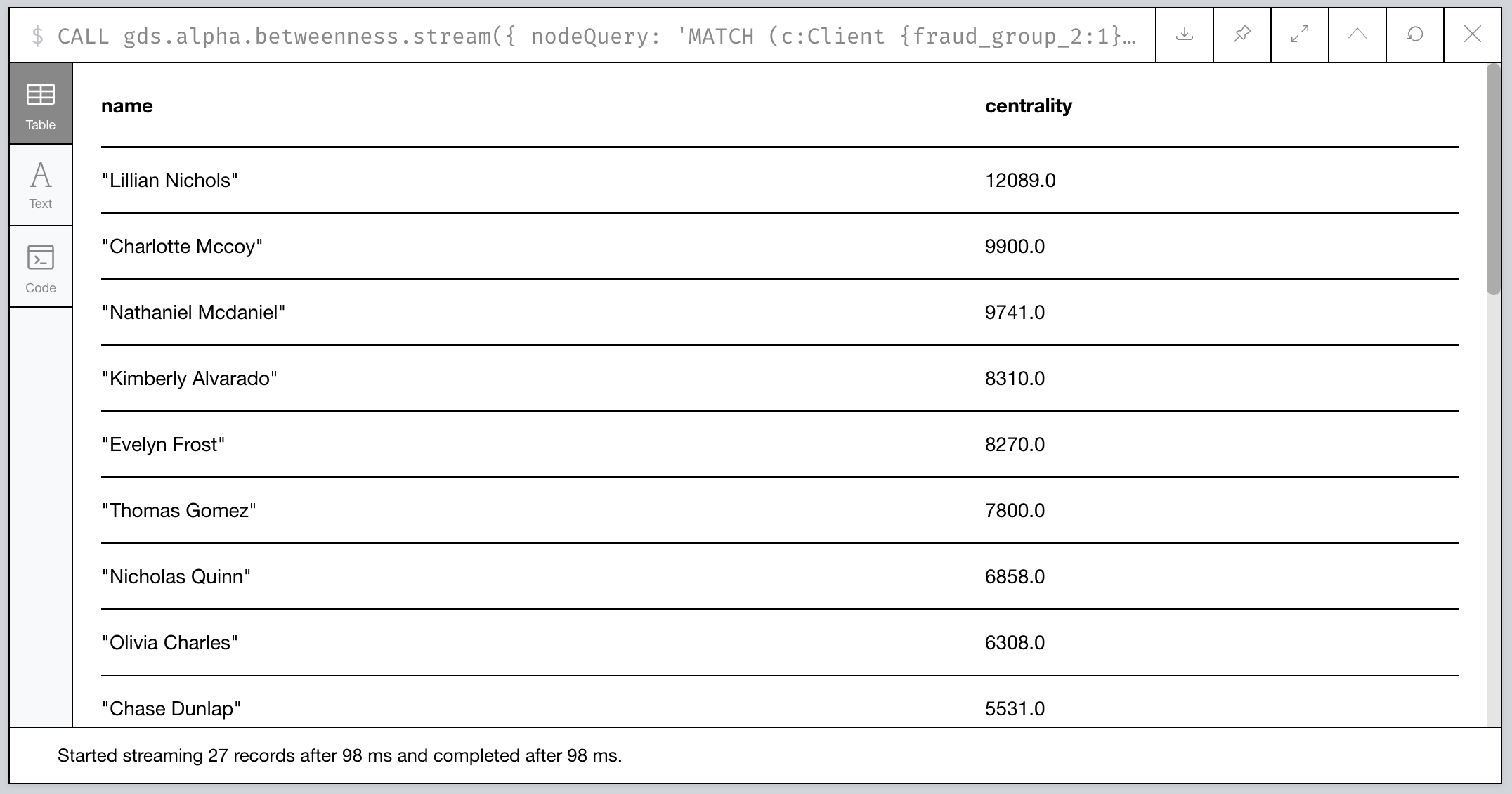

RETURN c.name AS name, centrality ORDER BY centrality DESC

Let’s take a look at the highest scores:

Figure 16: Clients of 2nd Level Fraud Group 1 sorted by Centrality

Hmm…not exactly who we had in mind. Can we tweak things?

Betweenness Centrality with a Twist

Algorithms aren’t meant to be run blindly. They’re a tool to be used with purpose. Let’s think for a minute about how we can adapt the centrality score in a way to help us find our 3 suspects.

What do all 3 have in common? For starters, they act as bridges between clusters in our group. Specifically they look like bridges with unique relationships to a single cluster member.

What about those with the current highest centrality scores? They’re pretty highly connected.

💡 Idea: what if we scale the score based on the number of connections?

// Same procedure call as before

CALL gds.alpha.betweenness.stream({

nodeQuery: 'MATCH (c:Client {fraud_group_2:1}) RETURN id(c) AS id',

relationshipQuery: 'MATCH (c1:Client)-[:TRANSACTED_WITH]-(c2:Client)

RETURN id(c1) AS source, id(c2) AS target'

}) YIELD nodeId, centrality

// Filter 0 scores again

WITH gds.util.asNode(nodeId) AS c, centrality WHERE centrality > 0

// Retrieve the relationships

MATCH (c)-[r:TRANSACTED_WITH]-(:Client)

// Collect and count the number of relationships

WITH c.name AS name, centrality, collect(r) AS txns

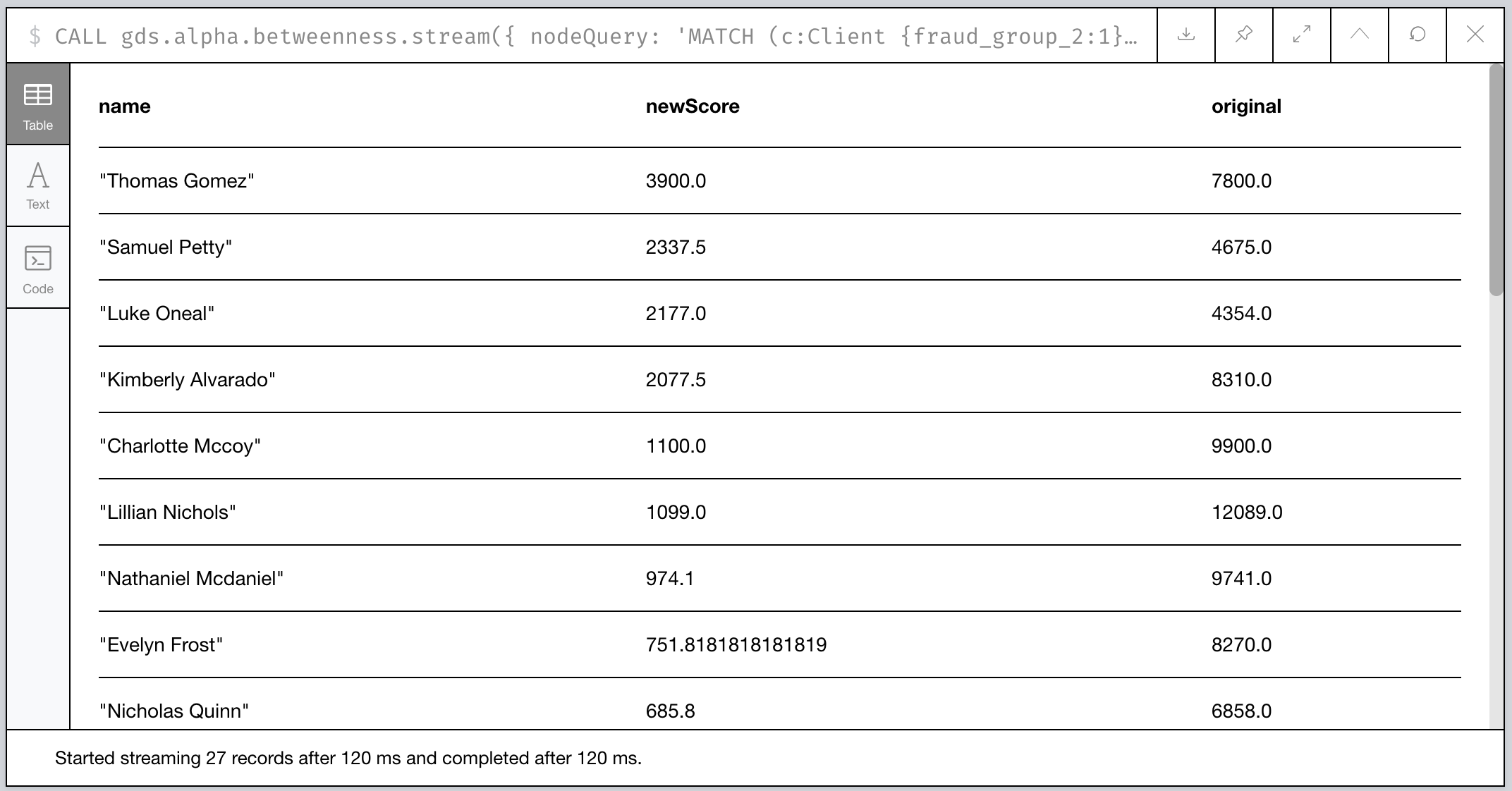

WITH name, centrality AS original, centrality/size(txns) AS newScore

// Our score is now scaled inversely to the number of relationships

RETURN name, newScore, original ORDER BY newScore DESC

Bingo! Our targets are now in the Top 3.

Figure 17: Our bespoke Betweenness Scoring

In Summary: What Did We Find?

To summarize, we used the Graph Data Science library to perform some critical steps in our analysis of our financial transaction data:

- We culled the universe down to potential First Party Fraudsters using Weakly Connected Components (WCC).

- We then isolated the largest groups to target our investigation.

- We expanded our search using the power of Cypher, finding out that the groups we identified looked very different than they first appeared!

- We re-ran WCC and retagged our suspects.

- We algorithmically found a way to identify linchpins in our largest potential fraud network using a combination of Betweenness Centrality and some old fashioned intuition!

Our take-away: look into three particularly shady characters!

🎓 Learning More

Make sure to check out some other great posts about using graphs and graph algorithms to investigate first party fraud.

I recommend Max Demarzi’s previous post and newly revised post on first party fraud for similar look at using algorithms:

- Part 1 in which he uses the previous “Graph Algorithms” library to identify fraud rings

- Part 2 in which he revises it using the newer “Graph Data Science” library we used in this post.

As well as a recent video overview of using Graphs in AI and Machine Learning from Neo4j’s Data Science and AI product managers.

Next Time: Investigating Fraudulent Charges

In the next post in this PaySim series, we’ll look at investigating fraudulent charges and finding potential sources of things like account theft through card skimming. Stay tuned!

👣 Footnotes

-

PaySim (original and my 2.1 version) both have a max transaction limit as well, so the highest possible value is capped. ↩︎

-

But, Dave, doesn’t Neo4j already try to keep the database in memory? Yes, but in this case, the graph algorithms library creates an even more optimized version of the data to speed up application of the algorithms. Check out the docs on the “project graph model”. ↩︎

-

This is what’s called a native projection in GDS-speak. ↩︎

-

See docs on the Cypher projection support in the Ne4j Graph Algorithms documentation. ↩︎

-

For use cases as to when to use Betweenness Centrality, check out the use-cases section of the official documentation. ↩︎